How Accident Insurance Helps Cover Medical Bills, Fractures And Income Loss

Accidents can happen anytime, anywhere—and often when you least expect them. While health insurance provides some financial support, it may not always cover the full cost of treatment, recovery, or loss of income due to an accident. This is where accident insurance plays a critical role in safeguarding both your health and your finances.

Whether you are dealing with a minor injury, a fracture, or a major disability, the right accident insurance plan can offer immediate relief through lump-sum payouts, medical reimbursements, and income protection. In this article, we explain how accident insurance complements your existing health cover and why it is just as important as having critical health insurance.

What is accident insurance?

Accident insurance, also known as personal accident insurance cover, is a type of health insurance that provides financial compensation in the event of accidental injuries, disability, or death. It differs from general health insurance in that it is designed specifically to deal with physical injuries resulting from accidents such as road mishaps, workplace injuries, or falls.

A standard plan may include:

● Hospitalisation and medical expenses due to accidents

● Compensation for temporary or permanent disability

● Payouts for fractures and burns

● Death benefit for nominees in case of fatal accidents

● Daily cash benefit for hospital stays

● Ambulance and emergency transport expenses

How accident insurance helps with medical bills

While health insurance covers hospitalisation and medical treatment, not all plans cover accidental OPD visits, fractures, or rehabilitation. Accident insurance bridges this gap by covering:

● Emergency treatment: Immediate care after an accident, including doctor consultations, scans, and diagnostics

● Surgical procedures: Surgeries required due to fractures or soft tissue injuries

● Post-hospitalisation care: Follow-up visits, physiotherapy, and medicines

● Room rent and ICU charges: Covered as part of the inpatient benefit

● Ambulance costs: Reimbursement for emergency transportation

This makes accident insurance a valuable backup that ensures you are not burdened with unexpected out-of-pocket costs.

Fracture coverage under accident insurance

One of the key benefits of accident insurance is specific compensation for fractures. Depending on the type and severity of the fracture, policyholders may receive:

● Lump-sum benefits for listed fractures (wrist, ankle, femur, etc.)

● Reimbursement for plaster, casts, and surgical fixation

● Recovery benefit during the healing period

● Support for diagnostic scans like X-rays, MRIs, and CTs

Unlike standard insurance which may only cover hospital bills, accident insurance directly compensates you for the injury—even if hospitalisation is not required.

Income protection through accident insurance

Accidents can lead to temporary or even permanent loss of income, particularly if you are self-employed or do not have paid sick leave. Most comprehensive accident insurance plans offer:

● Weekly income benefit: Fixed amount paid per week during recovery

● Permanent disability benefit: Lump sum payout based on the extent of disability

● Partial disability cover: Compensation for loss of function in a limb or body part

● Death benefit: One-time payment to your nominee in the event of accidental death

This ensures that your household finances remain stable while you recover. It also provides a critical cushion if your ability to work is compromised permanently.

Accident insurance vs critical health insurance

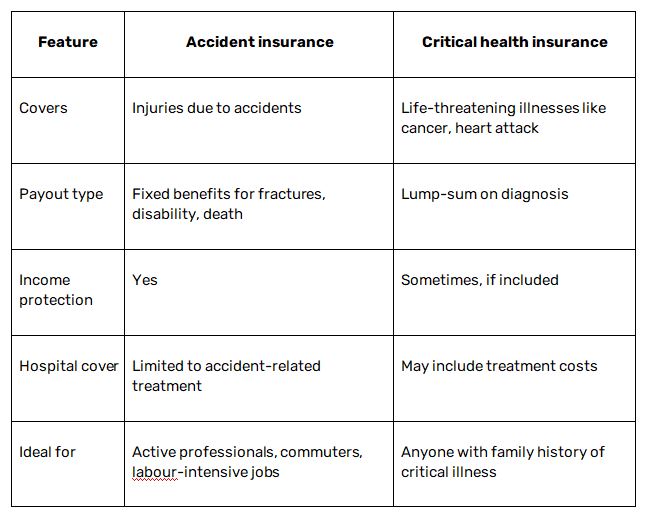

Both accident and critical health insurance serve different but equally important purposes. Here is how they compare:

While critical health insurance covers diseases that develop over time, accident insurance focuses on sudden, external events. Having both types of cover ensures comprehensive protection.

Who should buy accident insurance?

Accident insurance is recommended for:

● Working professionals: Especially those who commute regularly or work in high-risk environments

● Business owners and freelancers: Who do not have employer-provided sick leave

● Students and young adults: As a low-cost but high-coverage policy

● Senior citizens: Who are more prone to falls and fractures

● Families: Looking for add-on protection with base health insurance

It is also highly affordable, with premiums starting from as low as Rs. 300 per month for substantial coverage.

Choosing the right accident insurance plan

When comparing policies, look for the following features:

● High sum insured for accidental death and disability

● Weekly income or daily hospital cash benefit

● Broad fracture and burn cover

● Ambulance and OPD inclusions

● Easy claim process and minimal paperwork

● Compatibility with your critical health insurance or base mediclaim policy

Reading the policy wordings carefully and understanding exclusions (e.g., self-inflicted injuries, intoxication-related accidents) is essential before purchasing.

Conclusion

Accidents can impact your physical well-being and financial stability in an instant. A well-structured accident insurance plan ensures that you are financially equipped to handle medical expenses, fractures, and income disruptions without draining your savings.

By pairing it with critical health insurance, you create a safety net that covers both unforeseen injuries and long-term illnesses. In 2025, with increased mobility and occupational risks, investing in both types of cover is not just wise—it is essential.

Comments are closed.